Category Archives: Uncategorized

Do you want to get a positive credit rating?

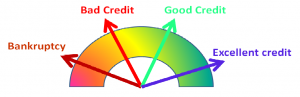

There are some major changes occurring in March 2014 with the way information is reported on your credit file. Historically, only bad credit ratings – missed repayments or defaults were reported on your credit file, which then made it difficult to obtain finance from lenders.

As a part of the reforms to the Privacy Act, new kinds of credit-related personal information can be collected about you. This includes whether you have made or missed a consumer credit payment. This is called ‘repayment history information’ or RHI. This has been happening from December 2012 and information will be available to credit providers from March 2014.

From March 2014, not only your negative but also your positive credit rating will be a factor in deciding whether you will be eligible to be provided with credit. This means that if you have failed to make full repayments on time since December 2012, it may affect your ability to obtain credit in the future.

Do you think it will affect you? Have you been making payments on time?

Hard Work pays off!

I wanted to share my recent victory with you. I participated in a pitch fest where there were 30 other entrepreneurs pitching their business. This was a peer-to-peer event and we all knew each other for the 40 weeks of business coaching we underwent together.

My aim was to be in the top 10 pitchers who then got a chance to pitch in front of a panel of judges. It was a very hard task for us entrepreneurs to get in front of people and pitch as a competition. For the last 3 weeks, in between my busy schedule, I have been preparing and practising my pitch.

Those who made the effort to research and practice reaped the benefits. I was in the top 10 and was quite ecstatic even though I didn’t win the top 3.

How does this tie in with mortgages?

Preparing to get a home loan is somewhat similar to practising for a competition. You should start getting ready at least three to four months before you actually want to make an application. You need to educate yourself, think and digest the information making sure that the one application you make is not rejected. Because getting a home loan application approved is something that you can shape for success.

A few examples of how this can help you..

1. You may have the 5% deposit in different bank accounts or it may be a gift from parents. If so, transfer the money into one account that is in your name and let it be for 3 months at least. Also, remember to keep adding to the 5% deposit to prove your savings capacity.

2. Changing jobs just before an application may not be the best thing to do.

3. Acquiring a new credit card or any other debt can reduce your borrowing capacity.

4. Never have late repayments or overdrawn amounts on any of your accounts – basically you need to prove good conduct on all accounts and bills and credit cards.

Do your work, be prepared and you will win the competition – in your case, finding the right home loan and getting it approved the first time.

Disclaimer: Please note that the advice above is of generic nature and it may or may not apply to your particular situation. Please contact us for a chat if you think we can help you.

Is this a proper pre-approval?

Last week I met a client who said they have a pre-approval from a bank, but still wanted to use my services. Ecstatic, I asked them to send me the pre-approval so that I can have a look and advise them if it was still valid.

What I actually was looking for was to see if the pre-approval was a proper pre-approval. Have a look at the pre-approval issued by the bank.

This approval is not worth the piece of paper it is written on. You may ask why?

A proper pre-approval is one that is issued by providing all the necessary documents (like payslips, bank statements, etc) and a credit assessor going through the documents with a completion of credit check and verification of employment, IDs and all relevant documents.

The one above indicated clearly that no credit checks have been done and the financial information has not been verified as well.

Not only is it incomplete, I can’t see the kind of home loan, interest rate, or any other information. It clearly indicates that nothing has been discussed with my clients. The bank manager (or more the loan officer) has just got preliminary information verbally and has printed this piece of paper and hence this pre-approval is not worth the piece of paper it is written on.

When my clients find a property, they will then have to go through a longer process of verification of all information rather than just valuation of property and LMI if applicable. This will take a longer time for formal approval to be issued.

Beware of these kind of pre-approvals and make sure you get a proper pre-approval issued for peace of mind.

Genworth LMI toolkit launched

Here is a new toolkit launched by Genworth for investors and the general public to understand lender’s mortgage insurance or LMI. As you are aware, if you borrow more than 80% of the purchase price, then you are liable to pay the lender’s mortgage insurance.

Check out this link for more information about the launch

http://bit.ly/1945cDZ

And this link for the actual Genworth page with the tool kit